All Categories

Featured

Table of Contents

Includes information on prices, qualification, renewability, limitations and exclusions. Not qualified for non-AARP members in AK, LA, and OR. The certified life insurance policy representative is D. N. Ogle (Arkansas # 17009138, The Golden State # 0L37586). The AARP Life Insurance policy Program is financed by New york city Life Insurance Policy Firm, New York, NY 10010 (NAIC # 66915).

Certain items, features and/or gifts not offered in all states or countries. New York City Life Insurance coverage Company is certified in all 50 states. There are other items available under the Program that have various costs, benefit amounts, coverage lengths, underwriting, and other features like persistent illness acceleration. Click here or require information.

Getting The 6 Best No-exam Life Insurance Of 2025 To Work

AARP has developed the AARP Life Insurance policy Depend on to hold group life insurance coverage policies for the advantage of AARP participants. Complete terms and problems are established forth in the team plan issued by New York Life to the Trustee of the AARP Life Insurance Policy Depend On.

Are you browsing for guaranteed acceptance life insurance policy without a waiting duration? Look no more! Our agency can provide to to almost any individual that is operating at least 20 hours a week. If you have actually been declined for insurance policy in the past, this can be your only option permanently insurance defense without a waiting duration.

The plan also provides optional riders for partners and children. You can insure your partner for up to $30,000 and your kids, aged 26 or younger, for as much as $20,000. While no added needs are needed to receive this coverage, it does boost the price compared to a single-person plan.

Our Term Life Insurance – Get A Quote Statements

Give us a phone call today and we'll assist you get going. In the table below we've offered some example prices by age and gender for $50,000 of guaranteed problem life insurance policy without a waiting period. If you acquire one on these policies, your family members or loved ones will certainly be shielded as quickly as you make your first settlement.

If these rates do not fit your spending plan, we'll aid you locate the perfect policy for your requirements. We can offer just $10,000 or as high as $75,000 of prompt surefire life insurance protection with no health info. To acquire an accurate quote, click in the form below, or call us toll-free at.

The trade-off with assured life insurance policies is that they do not provide full coverage for two-years. This suggests that if you pass away from any health-related concern throughout this time, your household will not obtain the full death advantage from your life insurance plan.

No waiting duration required. Your plan begins as quickly as you make your very first payment. Toll-Free: The majority of life insurance service providers will certainly not provide ensured approval life insurance to applicants that under the age of 40. Our company can provide as high as $75,000 of insurance coverage to almost anybody over the age of 18 if they are currently operating at least 20 hours a week.

7 Simple Techniques For How To Get Approved: Term Life Insurance Wicked Fast! ...

Provide us a telephone call today, toll-free:. Composed by: High cliff is an accredited life insurance agent and one of the proprietors of JRC Insurance policy Team. He has assisted countless households of companies with their life insurance policy needs considering that 2012 and specializes with applicants that are less than ideal health. In his extra time he enjoys spending quality time with household, taking a trip, and the outdoors.

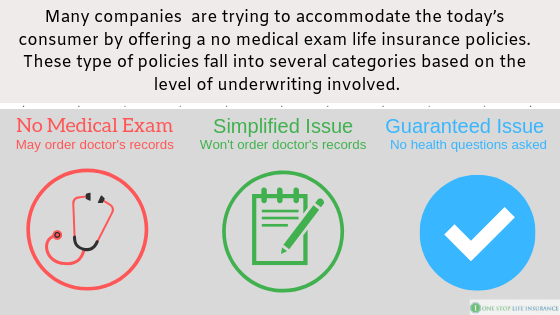

In this article, we'll answer one of the most often asked questions about life insurance coverage, no clinical exam.: No medical examination life insurance policy consists of term and entire life choices, with term being more economical and whole life offering lifelong coverage.: Insurance firms manage risk in no test plans by charging greater premiums or making use of alternate health information resources.

It is very important to keep in mind, however, that the death benefit is just payable if the insurance policy holder dies within the term. Term life insurance coverage is also attractive for seniors concentrating on long-lasting preparation. Choosing term life insurance policy without a medical examination can be beneficial, specifically if you have a clear concept of your protection duration.

The Buzz on Life Insurance

Selecting whole life insurance policy without a clinical examination simplifies the process and offers sustaining support. Comprehending the Infinite Banking Idea and How It Functions In Our Modern Environment 31-page eBook from McFie Insurance coverage Order here > Insurer are actually proficient at managing threat. They assess health and wellness and lifestyle information on each candidate and use this information to identify what quantity of premium will be required in order for the policy to be issued.

Table of Contents

Latest Posts

No Medical Exam Life Insurance For Seniors Over 75 for Dummies

4 Easy Facts About Best No-exam Life Insurance Companies (2025) Described

Indicators on Whole Life Insurance Quotes & Policies You Should Know

More

Latest Posts

No Medical Exam Life Insurance For Seniors Over 75 for Dummies

4 Easy Facts About Best No-exam Life Insurance Companies (2025) Described

Indicators on Whole Life Insurance Quotes & Policies You Should Know